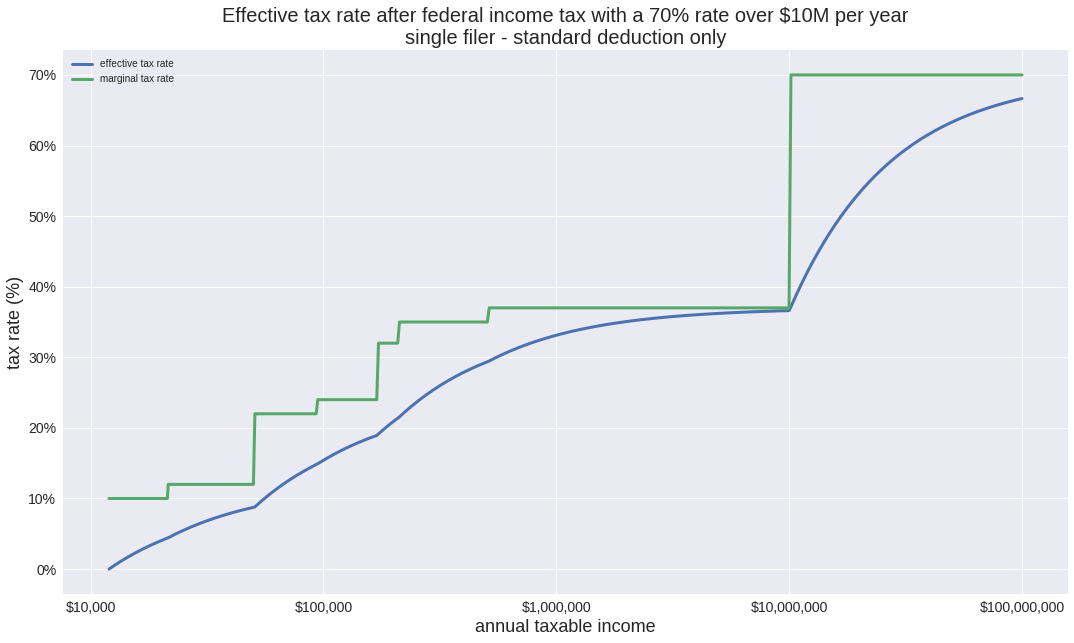

You can find tax brackets easily online. Here's a link. The rate per additional dollar earned in each bracket is its 'marginal tax rate'. How do you convert that into actual lost income or an actual effective tax rate? What if we added another bracket with a marginal rate of 70% for incomes greater than $10 million?

A simple way to understand it is to plot it. Here is a plot of post-tax income vs taxable income for an unmarried filer taking only the standard deduction:

Notice how as you move to the right, the post-tax income always goes up? The rate that it increases changes, but your post-tax income never goes down. You don't lose any money by moving up a bracket with a tax setup like this. You might earn too much for certain benefits and that can be a problem, but that's not related to the marginal tax rate.

Here is a plot of the effective tax rate vs taxable income for the same filer:

Notice how the effective tax rate is never quite as high as the marginal tax rate? If you're in the 32% bracket, you don't actually lose 32% of your income to federal tax.

In reality, you'll pay lower federal rates than this. There are other deductions and tax credits. Capital gains and dividends are also taxed at lower rates. That doesn't change the general idea though. Whatever your marginal rate is, your effective federal tax rate will always be below it, and will often be way below it.

Hopefully this clears up any misconceptions you might have heard similar to the opening questions. If any remain, just let me know in the comments.

This is great. Thanks!

ReplyDeleteIn the first chart annual taxable income vs. post-tax income, having a 1:1 aspect ratio chart could be insightful too.

Very good article and thanks for sharing such information. Already Read your Recent Post, its Great Thanks adoption certificate | return to work | fake doctors note | client information | savings trackers

DeleteOne tax reform issue that requires addressing is the amount of revenue that needs to be raised by the federal tax system. tax preparation

ReplyDeleteNice answers in replace of the question with real point of view and explaining about that. Online Event Registration Form Template

ReplyDeleteThank you for posting something like this keep up the good work. bank islami car finance - faysal bank credit card

ReplyDeleteWe have sell some products of different custom boxes.it is very useful and very low price please visits this site thanks and please share this post with your friends. best tax information site

ReplyDeleteAdditionally, when a star competitor is off the court or field always, it's conceivable to recapture thousands or even millions lost due to overpaid taxes.consulenza fiscale

ReplyDeleteBecause the calendar is continually updated, check back often to keep track of filing requirements, deadlines and other events that will help you stay current and up-to-date. kansas city income tax

ReplyDeleteYou make so many great points here that I read your article a couple of times. Your views are in accordance with my own for the most part. This is great content for your readers. Free Vehicle Collection Services Pangbourne

ReplyDeleteThis particular is usually apparently essential and moreover outstanding truth along with for sure fair-minded and moreover admittedly useful My business is looking to find in advance designed for this specific useful stuffs… Automatic Gearbox Problems Reading

ReplyDeleteThis particular papers fabulous, and My spouse and i enjoy each of the perform that you have placed into this. I’m sure that you will be making a really useful place. I has been additionally pleased. Good perform! https://europa-road.eu/hu/melybolcsos-szallitas-nemetorszagbol.php

ReplyDeleteThis is because of the way that their work would commonly be utilized in a court of law.The valuation of harms because of criminal and common wrong-doings should be finished with flawlessness and consequently information on business valuation hypothesis is the most fundamental. London accountant

ReplyDelete'Land Grab' has become a phrase on everyone's lips and has struck fear into the hearts of many potential buyers - and not a few owners of Spanish property currently living here. corporate investigations in spain

ReplyDeleteVery nice article, I enjoyed reading your post, very nice share, I want to twit this to my followers. Thanks!. axation of US Rental

ReplyDeletecfsasc

ReplyDeleteThanks for sharing the good stuff. It's a good stuff about the marginal tax rate which depends on different random factors. Keep sharing the good work. There are some random questions as well which help you to spend some good time.

ReplyDeleteYour articles are inventive. I am looking forward to reading the plethora of articles that you have linked here. Thumbs up! Fair Work Australia

ReplyDeleteI think this is an informative post and it is very useful and knowledgeable. therefore, I would like to thank you for the efforts you have made in writing this article. Your Virtual Office London yourvirtualofficelondon.co.uk

ReplyDeleteTo be an effective blogger, individuals are not needed to have broad specialized abilities however it's vital that you have skill in the field that you're expounding on. remote virtual work from home jobs

ReplyDeleteI just found this blog and have high hopes for it to continue. Keep up the great work, its hard to find good ones. I have added to my favorites. Thank You. Estonian company liquidation

ReplyDeleteSince time is important for them, they need not waste their time for rental cars, taxi cabs, or airport shuttles. Instead, they can book airport limo service in advance just by calling any reputable rental limousine service company. Luxury SUV Rental Miami

ReplyDeleteThank for sharing such a good content. I am very happy to reach to this blog.

ReplyDeleteIf you are bird lover, and looking for some great information to get instant

excess to quality bird related information, you can install the birdfeederist App.

This is exciting, nevertheless it is vital for you to visit this specific url: https://dynamichealthstaff.com/uk-nursing-recruitment-agencies-in-india

ReplyDeletePreceding building up an end interaction, you need to set up a real rulebook. On the off chance that your employees don't have a clue what you expect of them they can't be considered responsible for finishing those activities. földmunkagép szállítás Europa-Road Kft.

ReplyDeleteOnline slots We can't just focus on the game. But we have to look at the story of the number 1 online slots game that we choose to use as well. that he has the conditions to play or what kind of service conditions Usually every online casino There are often added bonuses. When we deposit money to play online slots games

ReplyDeleteAnnual expense forms documented by citizens are frequently inaccurate. At times they are erroneous because of straightforward errors, mishaps, oversight, disarray, or misconstruing of the law. Once in a while they inaccurate because of gross carelessness or foolish dismissal of the law.code of practice 9

ReplyDeleteGreat article Lot's of information to Read...Great Man Keep Posting and update to People..Thanks nursing test bank

ReplyDeleteIt is also recommended that you put all your cars under the same policy with your respective insurance company. cheap car insurance az

ReplyDeleteGetting criticism about your work can either give uplifting feedback that causes you to feel esteemed, or it can fill in key expertise and understanding holes that will assist you with taking care of your work and fit into your work climate all the more effectively. mélybölcsős szállítás Europa-Road Kft

ReplyDeleteBuying and selling domains is another way to earn money online. The goal is to buy domains at their registration prices, or lower, and then turnaround and trade them at a profit. make money online

ReplyDeleteVery efficiently written information. It will be beneficial to anybody who utilizes it, including me. Keep up the good work. For sure i will check out more posts. This site seems to get a good amount of visitors. tax advisors

ReplyDeleteI found your this post while searching for some related information on blog search...Its a good post..keep posting and update the information. इंडिया-टूरिस्ट-व्हिसा

ReplyDeleteNice to be visiting your blog again, it has been months for me. Well this article that i've been waited for so long. I need this article to complete my assignment in the college, and it has same topic with your article. Thanks, great share. Визаҳои-сайёҳии-Ҳиндустон

ReplyDeleteGreat article with excellent idea!Thank you for such a valuable article. I really appreciate for this great information.. 오피

ReplyDeleteSomeone Sometimes with visits your blog regularly and recommended it in my experience to read as well. The way of writing is excellent and also the content is top-notch. Thanks for that insight you provide the readers! 17609 valleyview ave, cleveland, oh 44135

ReplyDeleteIf you are borrowing money to pay your taxes, this is an additional cost which is over and above your required tax payment.Bookkeeping Services Toronto

ReplyDeleteI am always looking for some free kinds of stuff over the internet. There are also some companies which give free samples. But after visiting your blog, I do not visit too many blogs. Thanks. 新西蘭ETA簽證

ReplyDeleteThis is great content for your readers. 에볼루션바카라

ReplyDeleteI have read a few of the articles on your website now, and I really like your style of blogging. I added it to my favorites blog site list and will be checking back soon. Please check out my site as well and let me know what you think. INDIA EVISA

ReplyDeleteVery good written article. It will be supportive to anyone who utilizes it, including me. Keep doing what you are doing – can’r wait to read more posts. 안전놀이터

ReplyDelete"It’s really a nice and helpful piece of information. I’m happy that you

ReplyDeleteshared this useful information with us. Please stay us informed like this.

Thanks for sharing." 바카라사이트

retty good post. I just stumbled upon your blog and wanted to say that I have really enjoyed reading your blog posts. Any way I'll be subscribing to your feed and I hope you post again soon. Big thanks for the useful info. Bitmain Antminer

ReplyDeleteI really enjoy simply reading all of your weblogs. Simply wanted to inform you that you have people like me who appreciate your work. Definitely a great post. Hats off to you! The information that you have provided is very helpful. rat pest control london

ReplyDeleteIt’s very informative and you are obviously very knowledgeable in this area. You have opened my eyes to varying views on this topic with interesting and solid content. shipping from china

ReplyDeleteCool you write, the information is very good and interesting, I'll give you a link to my site Digital marketing sydney

ReplyDeleteIt’s very informative and you are obviously very knowledgeable in this area. You have opened my eyes to varying views on this topic with interesting and solid content. Shipping To FBA From China

ReplyDeleteit should go into my arrangement. For the most part fantastic work! french provincial furniture

ReplyDeleteGreat job for publishing such a beneficial web site. Your web log isn’t only useful but it is additionally really creative too. Courtier immobilier

ReplyDeleteI wish more authors of this type of content would take the time you did to research and write so well. I am very impressed with your vision and insight. restaurant chairs

ReplyDeleteThis is my first time i visit here and I found so many interesting stuff in your blog especially it's discussion, thank you. motorcycle dealer

ReplyDeleteThank you for sharing with us, I think this website genuinely stands Granny Flats

ReplyDeleteThe content is top character, you can easily find numerous exclusive. There is something special about them. Thanks for sharing this valuable information with all of us and if you are searching for the best. Please do keep up the great work. 안전놀이터

ReplyDeleteGreat post. I used to be checking continuously this blog and I’m impressed! Extremely helpful info particularly the final section I deal with such info much. I was looking for this certain info for a long time. Thank you and best of luck. 먹튀커뮤니티

ReplyDeleteIn this article understand the most important thing, the item will give you a keyword rich link a great useful website page 파워볼사이트

ReplyDeleteThis is worth it to read for everyone. Thank you for sharing good ideas to all your readers and continue inspiring us! 토토커뮤니티

ReplyDeleteExtraordinary message. I like to inspect this message considering I satisfied such a lot of brand-new authentic elements worrying it really 먹튀검증

ReplyDeleteI had been a little bit acquainted of this your broadcast provided bright clear idea 먹튀검증

ReplyDeleteI think that thanks for the valuabe information and insights you have so provided here 토토사이트

ReplyDeleteHi, great service, I really saw the traffic on my website, not conversions yet, I am sure this was quality traffic, anyway, I will come back again. 우리카지노

ReplyDeleteSo always take out a proper time while looking for because an effective bookkeeping is a great help in providing start-up ventures as well as small-scale businesses. Bookkeeping services for small business

ReplyDeleteA marketable strategy will assist with limiting the trouble and difficult work expected to lay out an individual injury law practice. https://www.natlawreview.com/article/20-elements-effective-pharmacy-compliance-program-nonexclusive-list-us-pharmacies

ReplyDeleteOn the other hand, each bar association is a member of the Union of Turkish Bar Associations in accordance with the Attorneyship Law. Lawyers practicing law in Ankara are also called Ankara Lawyers in daily life. Ankara avukat

ReplyDeleteone thing that I like about the blog could be that the data is useful and keeps one educated on issues identified with governmental issues. Merchant Services ISO

ReplyDeleteI really welcome this great post that you have obliged us. I ensure this would be significant for by far most of the overall public. how to be a merchant service provider

ReplyDeleteThank you because you have been willing to share information with us. we will always appreciate all you have done here because I know you are very concerned with our. ucdm youtube

ReplyDeleteI am enjoying every bit of it. It is a good site, as well as the stock is well-chosen. Thank you emergency visa application India, emergency visa to India application form you can fill online. within 1 to 3 business days you can get your visa via fast track Indian visa services.

ReplyDeleteThank you The international travelers who travel to Kenya need visa to Kenya from usa. That they can apply online and can get the 24*7 customer assistant.

ReplyDeleteGunadika, section head of tourism for Bali Province, told CNN.

ReplyDelete부산출장안마

The two-digit number accounts for the period between January and October 2021 and

ReplyDelete부산마사지

two have become inseparable. This interview has been edited for length and clarity.

ReplyDelete창원출장 https://www.homemcms.com/changwon

just a few short decades through industrial fishing. Nobody really understands

ReplyDelete창원출장타이 https://www.homemcms.com/changwon

For paying through e-mode one requires to fill an online form with all the details. Once you have filled your form, you are required to enter the credit card number and a special code which is written behind the card. explore this link

ReplyDeleteCool you write, the information is very good and interesting, I'll give you a link to my site. webpage

ReplyDeletehas since become an emblem for Aboriginal Australians and is often seen

ReplyDeletehttps://www.homemcms.com/busan

for Indigenous Australians, Linda Burney, using a TV appearance on Sky News

ReplyDeletehttps://www.homemcms.com/busan 부산출장서비스

But JP Morgan Chase shows us it doesn't need to be this way if we all seek the greater good.작업대출

ReplyDeleteWhenever you restore your own poor credit score you'll be able to possess the monetary independence to possess credit score prolonged for you for all those points you actually would like or even which home you've already been operating therefore difficult in order to be eligible for a. md credit repair

ReplyDeleteHello sir, Have a great evening! If you are willing to travel to Pakistan, everything is online nowadays. You can check online all Pakistan visa requirements. No need to visit any embassy & consulate. You can check on our website.

ReplyDelete

ReplyDeleteNice post! This is a very nice blog that I will definitively come back to more times this year! Thanks for informative post.Best Mortgage Rate in Kitchener

Find the best Fixed mortgage rate in Toronto that work perfectly for you. We make it easy to compare rates in Toronto big banks and top brokers for free. Best Mortgage Rate in Toronto

ReplyDeleteThe amount of additional tax paid for each new dollar of income received is known as the marginal tax rate. Total taxes paid divided by total income generated is the average tax rate. At a marginal tax rate of 10%, tax would be deducted from the following dollar of income at a rate of 10%.

ReplyDeleteSutherland property tax accountant

We Are a Trusted Leader Among Retail Branding & Digital Marketing,Digital Printing Services in Dubai, Abu Dhabi & UAE

ReplyDeletehttps://brandzee22.com/

When you choose a tax consultant, you’re choosing peace of mind and professional expertise. Payroll Services

ReplyDeleteThis organization helps people understand eligibility easily. Section 125 Cafeteria Plan

ReplyDeleteCost segregation unlocks early tax benefits. section 125 cafeteria plan

ReplyDelete